The world’s central bankers are unleashing what might show to be probably the most aggressive tightening of financial coverage because the Eighties, risking recessions and roiling monetary markets as they rush to sort out the surge in inflation they didn’t see coming.

Article content material

(Bloomberg) — The world’s central bankers are unleashing what might show to be probably the most aggressive tightening of financial coverage because the Eighties, risking recessions and roiling monetary markets as they rush to sort out the surge in inflation they didn’t see coming.

Commercial 2

Article content material

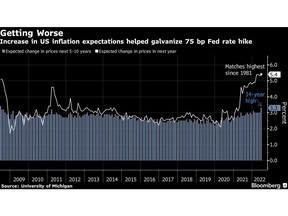

The week started with a sudden shift on Wall Avenue to cost in a 75 foundation level interest-rate improve by the Federal Reserve. The US central financial institution delivered that on Wednesday — the most important transfer since 1994 — as Chairman Jerome Powell declared himself “strongly dedicated to bringing inflation again down.”

Switzerland unexpectedly raised charges the following day, whereas the Financial institution of England hiked shortly after by 25 foundation factors for a fifth time and signaled it can quickly double the tempo.

The bond market’s response to the concerted withdrawal of stimulus proved so violent the European Central Financial institution Wednesday held an emergency assembly to handle surging yields in some euro-zone members. Rising markets from Brazil to Taiwan to Hungary additionally lifted borrowing prices, whereas Australia, South Korea, India, New Zealand and Canada are amongst these getting ready extra motion.

Commercial 3

Article content material

Solely the Financial institution of Japan bucked the development, sustaining its ultra-easy settings on Friday regardless of fierce market stress to leap on the worldwide bandwagon.

China additionally stands out as an exception, however merchants all over the world are bracing for a sequence of price hikes many is not going to have witnessed of their whole careers. Fed officers alone are projecting they are going to take their benchmark to three.8% by the tip of 2023, from the 1.5%-2% vary it hit this week, and a number of other Wall Avenue banks see an excellent greater peak.

Coverage makers are being pressured to behave partially as a result of they failed to identify the sticking energy of inflation’s rise to multi-decade highs. They had been then sluggish to reply even once they accepted the worth pressures weren’t “transitory.” 2022 started with US charges nonetheless close to zero and the Fed sucking in Treasuries and mortgage-backed securities.

Commercial 4

Article content material

The scramble to regain management raises the specter of unintended penalties, together with recessions and better unemployment. Its additionally a recipe for risky monetary markets.

“It’s trying fairly chaotic by way of the financial system and the challenges dealing with central banks,” stated Nathan Sheets, international chief economist at Citigroup Inc. and a former Fed official. “The defining function of this climbing cycle relative to others we’ve seen during the last 30 years is that central banks should not simply incrementally behind the curve, they’re considerably behind.”

The newest drama started with final Friday’s information of one other soar in US inflation. When media reviews emerged Monday that the Fed would actively contemplate a three-quarter level price transfer, authorities bond yields surged anew, and the S&P 500 tumbled right into a bear market. Ten-year US yields had been round 3.2% Thursday, greater than double the beginning of the 12 months.

Commercial 5

Article content material

World shocks to demand and provide over the previous two years — brought on by the pandemic, switching out and in of lockdowns, historic stimulus packages and Russia’s invasion of Ukraine — have all contributed to a sea-change for financial coverage.

After spending current a long time assuming that they had tamed costs maybe an excessive amount of, officers at the moment are having to clamp down on progress and hiring. Inflation is greater than triple the Fed’s goal and heading into double figures within the UK.

“What we’ve to know — and markets are coming to phrases with this — the extra aggressive you deal with inflation, the extra you’re going to have output volatility and stress in monetary markets,” former SNB President Philipp Hildebrand, now a vice chairman at BlackRock Inc, advised Bloomberg Tv.

Commercial 6

Article content material

The Fed’s growing hawkishness additionally places stress on its friends, by driving up the greenback and contributing to a worldwide selloff in bonds. Italian 10-year yields hit their highest since 2014 on Tuesday and the yen is at its weakest in 24 years.

The ECB is now crafting a software it hopes will insulate its weak economies from greater yields, whereas the Financial institution of Japan on Friday added alternate charges to its listing of dangers. Some are speaking of “reverse forex wars,” the mirror picture of the early 2010s, when key nations had been accused of stopping forex appreciation so as to stoke progress. At the moment, a powerful alternate price is well-liked.

“We’re in an built-in international capital market,” stated Julia Coronado, co-founder of MacroPolicy Views LLC. “If the Fed goes quite a bit sooner, that’s going to pressure the currencies and make the roles of the opposite central banks quite a bit more durable.”

Commercial 7

Article content material

Hildebrand stated it’s unlikely the Fed can engineer a delicate touchdown. Bloomberg Economics pegs the possibility of a US recession at 72% by the tip of subsequent 12 months, which can problem the re-election hopes of President Joe Biden.

These on the entrance traces of the world financial system are additionally selecting up on the brand new actuality.

“Issues have modified dramatically,” stated Suren Fernando, chief govt officer of MAS Holdings, which makes gadgets together with sportswear, efficiency put on and swimwear.

American and European clients at the moment are warning of a weakening marketplace for the second half of this 12 months and possibly for a part of 2023, stated Fernando, whose agency employs 115,000 individuals throughout 16 international locations.

“We hope the central banks are proper that it’s going to be a delicate touchdown.”