Cet article est réservé à nos membres

Chapter 3

Behind the inexperienced curtain, biodiversity is being destroyed

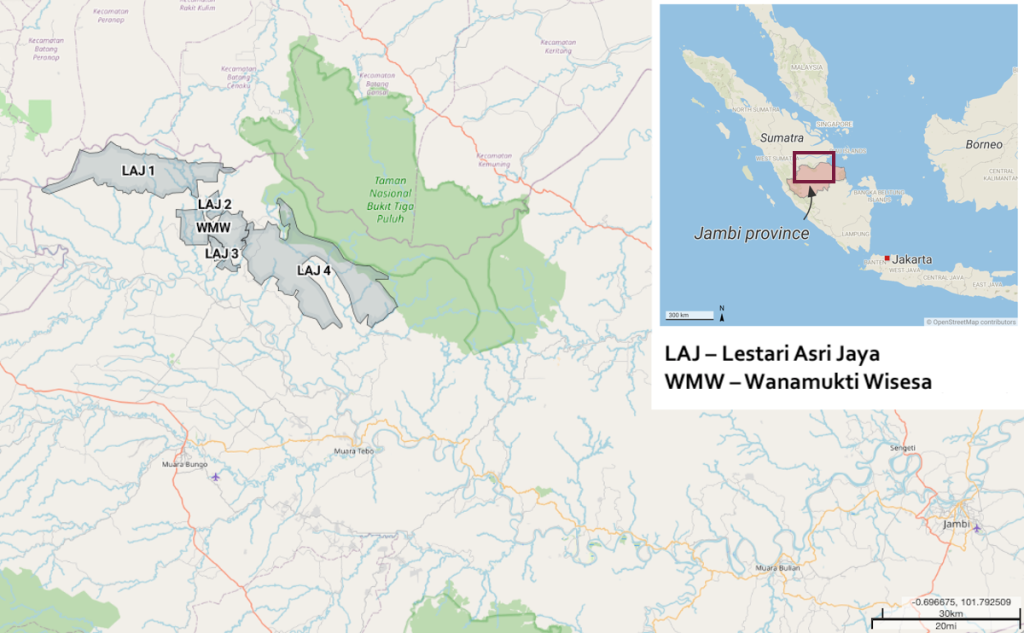

Within the earlier chapters, we noticed how in 2018 Michelin used inexperienced bonds to finance the rubber plantations of its new Indonesian associate Royal Lestari Utama (RLU) within the Indonesian province of Jambi, on the island of Sumatra. The bonds, designed to assist sustainable tasks and marketed by BNP Paribas, have been issued by the brand new sustainable-finance platform Tropical Landscapes Finance Facility (TLFF). They have been additionally endorsed by quite a few third events who have been discovered to have primarily based their assessments solely on paperwork.

Michelin and its companions additionally ignored warnings from grassroots organisations in regards to the industrial-scale deforestation beforehand carried out by RLU’s native subsidiary.

👉 Learn chapter 1: European inexperienced finance is paying for deforestation in Indonesia: the case of Michelin

👉 Learn chapter 2: How a mission decried for its environmental influence grew to become a flagship of European inexperienced finance

So as to not jeopardise the success of a mannequin mission, Michelin and the founders of the TLFF failed to speak these info to potential buyers, who might need been much less enthusiastic if they’d recognized about them. We’ll now have a look at how all this was doable – and why it shouldn’t have been, given the foundations of inexperienced finance and the scenario on the bottom in Sumatra.

It was the “visa” granted in January 2018 by the ethical-investment rankings company Vigeo Eiris, certifying compliance with the rules of the Worldwide Capital Market Affiliation (ICMA), that allowed TLFF bonds to be registered within the database of Local weather Bonds Initiative. CBI is the world’s main certifier of local weather fundraising, and Vigeo Eiris is a CBI-approved auditor.

Obtain the most effective of European journalism straight to your inbox each Thursday

Obtain the most effective of European journalism straight to your inbox each Thursday

The accreditation of the bonds within the CBI’s Local weather Pleasant Funding Showcase helped their repute and visibility to potential buyers. “Our database is searched to see what’s inexperienced. If bonds don’t meet the factors of our database, they can’t be included within the green-bond indexes,” defined Caroline Harrison, analysis director at CBI, to Voxeurop. This was confirmed by Alex Wijeratna of the environmental NGO Mighty Earth: “Portfolio managers can assume that if TLFF bonds are a part of a good inexperienced index, then the funding is sweet to go.“

CBI thought of that Royal Lestari Utama’s plantations offered advantages for local weather safety, because the cultivation of rubber timber was a type of carbon sequestration. Moreover, the involvement of native farmers in rubber manufacturing, alongside meals crops, improves their dwelling situations and prevents them from having to additional broaden their agricultural land on the expense of forest areas.

Counting on the flawed Vigeo Eiris evaluation (see Chapter 2), CBI endorsed the TLFF’s obligations with out taking into consideration the greenhouse gases launched by previous deforestation. CBI couldn’t have been conscious of this, on condition that RLU and BNP had didn’t report it to Vigeo Eiris. Furthermore, CBI’s methodology within the agricultural sector thought of {that a} discount in emissions through the interval of the funding – which on this case formally started in 2018 (the date of the transaction by TLFF) – was adequate. Nevertheless, we realized (see Chapter 1) that the inexperienced bonds have been partly used to finance, retroactively, the clearcutting that happened previous to the three way partnership between Michelin and Barito. Slightly than sequestering carbon, this deforestation contributed to carbon emissions.

A breach of the rules of inexperienced bonds

In a letter to the Local weather Bonds Initiative in March 2021, Mighty Earth requested it to take away the TLFF bonds from its database. The environmental NGO argued that “this failure to reveal […] the recognized key info that the subsidiary of Michelin’s native associate […] was one of many main causes of the land clearing and deforestation on its concessions in Jambi […] constitutes an especially critical – and finally deceptive – omission and […] a gross violation of Inexperienced and Sustainability Bond rules” established by ICMA. These require clear disclosure of the environmental dangers related to funded tasks (1).

In line with an ICMA professional on sustainable finance who wished to stay nameless, “it needs to be clear that land conversion and deforestation should not within the spirit of inexperienced bonds, even assuming that the ultimate [outcome] is inexperienced, as within the case of sustainable agriculture for instance. Exterior auditors and buyers would probably not endorse this [as] their repute may endure.”

With reference to Mighty Earth’s initiative, Sean Kidney, executiver director of CBI, advised Voxeurop: “We do not do area checks, we depend on impartial reviewers. On this case, the bonds had obtained a second opinion [the assessment of Vigeo Eiris, a ratings agency specialised in ethical investments] and the unique paperwork made no reference to any deforestation. Then again, if we discover out from our personal sources in Indonesia that there was an issue, then we’ll merely take away the bonds from our checklist. Certainly, underneath our retrospective interval, no deforestation should have taken place within the final ten years.” Michelin has already repaid the bonds to buyers, so any motion by CBI would now come a little bit late.

Paul Vermaak, director of requirements at CBI, advised Voxeurop: “Our database can settle for bonds that assist the sustainable transition of agribusinesses with a historical past of land conversion – i.e. it should have taken place lengthy earlier than – however not those who may assist corporations which have cleared the forest simply earlier than publishing a ‘no-deforestation coverage’. This might be a manipulation of the system to unfairly extract cash from buyers. It could be as much as ICMA’s certified reviewers to keep away from such an unintended consequence.”

Vermaak confirmed that “if the corporate has deforested the land, because of this it has generated important [carbon] emissions and eliminated a high-carbon-sequestration habitat, earlier than changing it with lower-sequestration agricultural manufacturing actions. Such a situation is implicitly inconsistent with our taxonomy” (2). He added that the CBI is dedicated to revising its evaluation standards to exclude, sooner or later, any mission that doesn’t adjust to the “Do no important hurt” (DNSH) precept (3).

To cover the clearcutting that preceded the three way partnership between Michelin and Barito Pacific may thus moderately be described as a breach of the green-bond tips set out by the Worldwide Capital Market Affiliation and the CBI. It additionally compromised RLU’s adherence to the Environmental and Social Sustainability Efficiency Requirements of the Worldwide Finance Company (IFC), the personal funding arm of the World Financial institution.

Certainly, the environmental, social and governance (ESG) standards talked about within the green-bond prospectus proclaim full compliance with the ICMA rules in addition to with the IFC requirements. Royal Lestari Utama ought to due to this fact have been topic to the identical environmental and social necessities as these for corporations making use of for IFC funding. In its Second Occasion Opinion – a type of audit – Vigeo Eiris made it clear that the environmental advantages of the mission “are conditional on the implementation of the […] IFC efficiency requirements”.

Amongst these, the chapter on conservation blacklists tasks that lead to a web lack of biodiversity – an idea that features any pure forest that represents an vital habitat for threatened species or for indigenous communities.

With out referring particularly to RLU, the IFC press workplace urged that its enterprise may properly fall underneath this non-compliance clause. In an electronic mail trade with Voxeurop, it stated that “the implementation of the nationwide authorized framework” and “the corporate’s non-deforestation coverage don’t come into play […], i.e. it doesn’t matter whether or not or not the corporate had such a coverage or a clearing allow (the place it has degraded the habitat), it nonetheless has to show […] that its mission resulted in no web loss (of biodiversity) […]” to adjust to the IFC requirements.

Particularly, the IFC considers that corporations are answerable for any biodiversity loss they trigger by intentionally degrading a pure habitat “in anticipation of acquiring financing from a lender […] for the mission”.

Deforesting and replanting, as shortly as doable

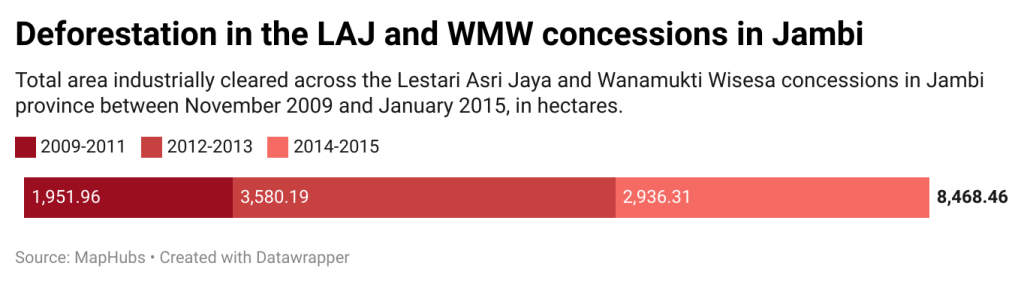

This appears to be precisely what occurred. The confidential report of the auditing agency TFT/Earthworm, seen by Voxeurop, reveals that Lestari Asri Jaya (LAJ), the RLU subsidiary that operates the Jambi concessions, continued to clear land till late 2014. Certainly, in accordance with each the green-bond prospectus and the newest impartial report on environmental safety within the LAJ concession, revealed in Could 2022 by Comment Asia and Daemeter Consulting, rubber planting in truth exploded (4) between early 2013 – when Michelin first visited the positioning – and late 2014, when the three way partnership was signed.