Britain’s coverage makers are hardening their perspective towards inflation, getting ready to ship a tricky dose of medication at a time when a cost-of-living disaster is weighing down development and customers.

Article content material

(Bloomberg) — Britain’s coverage makers are hardening their perspective towards inflation, getting ready to ship a tricky dose of medication at a time when a cost-of-living disaster is weighing down development and customers.

Commercial 2

Article content material

Prime Minister Boris Johnson’s authorities together with the Financial institution of England this week signaled a readiness to boost rates of interest at an unprecedented tempo to rein in costs, that are on observe to leap greater than 11% this yr.

Remarks from the Treasury and central financial institution point out a swap of coverage emphasis from supporting development to stopping inflation seeping into wages and triggering a Nineteen Seventies-style value spiral.

The strikes comply with the most important improve in rates of interest within the US since 1994 and requires the BOE to step up its financial tightening.

“The rhetoric was dialed up a notch, with the Financial institution saying it might should act ‘forcefully’ ought to it’s required,” stated George Buckley, UK economist at Nomura Holdings Inc.

Johnson has been elevating issues about inflation for the previous couple of weeks and took up the difficulty once more on Monday, warning that the UK is headed for a tough stretch.

Commercial 3

Article content material

“We’re seeing the results of inflation world wide hitting this nation in addition to all over the place else,” the prime minister stated at an occasion in Cornwall. “We’ve received an inflationary value bump that we’ve received to get by.”

On Tuesday, authorities knowledge confirmed actual wages falling at their quickest tempo in 20 years.

The BOE on Thursday raised its benchmark lending charge 1 / 4 level to 1.25%, the best since 2009, and advised it might step up the tempo of tightening at its subsequent assembly in August.

BOE Chief Economist Huw Tablet advised Friday that additional proof of inflation driving up wages or store costs might tip the financial institution towards a half-point charge hike. Traders guess the BOE will ship a number of out-sized will increase this yr, bringing the important thing charge to three%.

Commercial 4

Article content material

Chancellor of the Exchequer Rishi Sunak made it clear he expects charge setters to get inflation expectations beneath management.

“I do know and count on that you’ll take the motion essential to get inflation again heading in the right direction and guarantee inflation expectations stay firmly anchored,” Sunak wrote in his letter to the BOE.

The letter alternate is required after rate-setting conferences when inflation is greater than 1 level off the two% goal. Inflation is at present 9%, and the BOE expects it to rise extra.

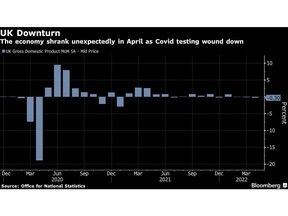

The outlook for charges got here regardless of knowledge displaying the economic system shrank within the three months by June and indicators that client confidence is crashing.

The dimensions of motion that markets anticipate is unprecedented within the BOE’s fashionable historical past. The financial institution has by no means raised charges by greater than 1 / 4 level at a single assembly in its 25 years of independence.

Commercial 5

Article content material

There was a noticeably hawkish shift on the policymaking committee as an entire, with two members who had been hesitant about additional charge rises now signed up for the “forceful” steering. Tablet advised Bloomberg TV on Friday the outdated steering was “a bit stale.”

He additionally bolstered the message that inflation expectations are paramount, saying: “If we see higher proof that the present excessive degree of inflation is turning into embedded in pricing behaviour by companies, in wage setting behaviour by companies and staff, then that would be the set off for this extra aggressive motion.”

All the main focus now seems to be on stopping inflation expectations dropping their 2% anchor. Quick time period expectations are “near their file excessive,” the BOE stated on Thursday and “medium to longer-term expectations remained above their historic averages.”

Commercial 6

Article content material

Sunak’s letter was notably extra matter-of-fact than earlier exchanges, with a transparent concern that inflation might turning into untethered.

“It’s crucial to deliver inflation again down to focus on and to maintain it anchored there,” the chancellor wrote.

He additionally changed the pleasantry, “I welcome the committee’s intention to take no matter motion is important” with a extra instructive, “I welcome that the Financial institution is ready to take agency and decisive motion to realize this.”

The BOE is beneath stress to maneuver sooner and tougher, with a number of ruling Conservative Social gathering MPs not too long ago criticizing it for permitting costs to spiral upwards and plenty of economists claiming it was too gradual to reply.

Mel Stride, chairman of the cross-party Treasury Committee within the Home of Commons, stated that a few of Bailey’s communications had been “clumsy.”

Tablet advised Bloomberg TV that there was nothing the BOE can do in regards to the speedy quick time period inflation pressures.

“We all know goes to go greater attributable to power value actions and different issues which we are able to’t actually include shorter time period,” he stated.