This text is reserved for our members

Introduction

The inexperienced gold rush

Within the battle in opposition to world warming and its penalties, inexperienced finance appears to be like like a formidable lever. Investing in sustainable, environmentally pleasant initiatives relatively than in fossil fuels – it’s an apparent alternative to reply to the more and more urgent calls for of public opinion and sure buyers.

So it isn’t stunning {that a} rising variety of corporations are utilizing inexperienced finance to develop their enterprise. They’re pushed by a real dedication to ethics and ecology, in addition to the want to highlight their advantage in company communication.

Developed within the 2010s and formalised by the Paris Local weather Settlement in 2015 (the date is vital, we are going to come again to it), the time period “inexperienced finance” encompasses an array of instruments, devices and actors. It options acronyms and mechanisms that aren’t at all times straightforward to know.

Whereas now we have endeavoured to make the next data accessible and comprehensible, the subject material stays difficult. The excellent news is that by the point you get to the top of this story, your perspective on inexperienced finance needs to be as clear as a primeval forest razed by chainsaws.

Let’s start with Michelin. Among the many European corporations that delight themselves on their “sustainable” insurance policies, the tyre big highlights its dedication to “accountable and sustainable administration of the rubber trade (rubber tree cultivation), […its] ambition of zero deforestation, and its dedication to defending biodiversity”. That is how the agency reassures its shareholders and prospects that its tyres are extra eco-friendly than these of its rivals.

The flagship of Michelin’s dedication to sustainable pure rubber is the Royal Lestari Utama (RLU) undertaking in Indonesia. Created in 2015, it’s a three way partnership between Michelin and its native accomplice Barito Pacific. The undertaking is introduced in business movies as the last word success story: planting rubber timber to reforest areas devastated by unlawful logging, whereas creating jobs for native individuals and defending natural world – particularly, elephants, orangutans and child tigers.

Obtain the most effective of European journalism straight to your inbox each Thursday

All this with the involvement of the World Wildlife Fund (WWF), the United Nations Setting Programme (UNEP) and the United States Company for Worldwide Improvement (USAID), who collectively have introduced it as a mannequin of a sustainable worth chain.

After an alarming report by the environmental NGO Mighty Earth in 2020, an investigation performed by Voxeurop over greater than a yr and a half with our companions from Tempo journal in Jakarta reveals the bounds of this operation financed by $95 million of “inexperienced bonds”. From the hushed places of work of Europe to the Indonesian forest, through the buying and selling rooms of Singapore, our reporters have scrutinised paperwork, reviews and correspondence, and interviewed the principle gamers within the corporations, NGOs and native communities involved. The image that emerges just isn’t the joyful one offered to European buyers.

In June 2022 Michelin made a full takeover of the RLU three way partnership. This led, two months later, to the early redemption of the inexperienced bonds issued by French financial institution BNP Paribas, greater than 10 years earlier than their scheduled maturity. Buyers subsequently not have a say within the matter. Nonetheless, they may certainly have an interest to know the affect of the operation they helped to finance.

Past the actors immediately involved, and past the affair’s affect on Indonesian individuals and biodiversity, our investigation additionally lifts the veil on the structural issues of the younger green-finance motion: opacity of the certification mechanisms, non-binding voluntary commitments, absence of impartial audits, and hype for initiatives which might be alleged to be emblematic of a – lastly – sustainable financial system.

It highlights the issues created by the dearth of efficient regulation at EU stage which may have an actual affect on biodiversity and the local weather disaster, particularly when European multinationals function removed from our shores. The European Union has taken up the problem and is at the moment engaged on a regulation regarding inexperienced bonds, however this can solely come into drive in 2023. One other regarding imported deforestation can be within the strategy of being authorised.

Chapter 1

Funding alternative: “inexperienced” bonds

Formally, the story begins on 14 December 2014, when Michelin acquired 49% of Royal Lestari Utama (RLU), an agro-forestry firm owned by the Indonesian conglomerate Barito Pacific Group. The latter was based and led by the rich businessman Prajogo Pangestu, dubbed the “Timber King” of Indonesia. Based on the Mighty Earth report cited above, the corporate already had a monitor file of deforestation, land grabbing, unlawful logging and offshore tax evasion utilizing a fancy community of corporations concerned in timber, pulp and palm oil.

Michelin goes inexperienced

Whereas the corporate of the Michelin Man had been current in Indonesia since a minimum of 2004, the three way partnership with Barito Pacific, formalised in the beginning of 2015, had the political assist of the Indonesian authorities. It had very grand ambitions: to contribute in a sustainable option to round 10% of Michelin’s world provide of pure rubber, by counting on native communities for manufacturing and safety of ecosystems. A number of websites are concerned, within the provinces of Jambi (Sumatra island) and East Kalimantan (Borneo island).

To strengthen the credibility of its “inexperienced rubber” undertaking, Michelin determined to contain WWF in its enterprise with Barito Pacific. Later WWF was co-opted into the World Platform for Sustainable Pure Rubber (GPSNR), created by Michelin itself in 2018.

“We now have lengthy campaigned to cease deforestation in Sumatra, highlighting the intensive deforestation perpetrated by corporations like Barito Pacific Group […]. So when the chance arose in late 2014 […] to affect what would develop into the Royal Lestari Utama undertaking, we noticed this as a invaluable alternative […] to realize a milestone,” a WWF spokesperson advised Voxeurop on situation of anonymity. “We partnered with Michelin […] as a way to assist rework the pure rubber market, to scale back the corporate’s world environmental footprint and to protect precedence ecosystems.”

Michelin was on the time making substantial efforts to inexperienced its operations and its picture, internationally. The agency obtained the highest rating for company social and environmental duty among the many corporations audited below France’s Responsibility of Vigilance legislation. It additionally dedicated to a biodiversity roadmap for 2030 and printed information on the affect of its enterprise on local weather change.

It was on this laudable spirit that Michelin inspired Barito to go inexperienced as properly. In March 2015, the 2 corporations signed a no-deforestation dedication: future enlargement of RLU’s rubber concessions would solely be potential on current farmland, respecting wildlife habitats.

A funding-starved undertaking saved by the green-bond gong

Upon signature, Michelin aimed to extend manufacturing within the Barito Pacific concessions from 0.7 to 1.8 tonnes of pure rubber per hectare. The annual goal was round 80,000 tonnes per yr. Three quarters of this manufacturing would go to Indonesian factories supplying Michelin by means of its provide subsidiary, Société des Matières Tropicales (SMPT), with the remaining going to exterior patrons.

Collectively, the 2 shareholders of RLU guess on a 23-year marketing strategy till 2040. They put a mixed $100 million of fairness (following a subsequent recapitalisation, Michelin can have paid a complete of 55 million) into the three way partnership’s coffers. This was lower than essential to maintain their dangerous undertaking, provided that their forecasted income have been minimize by the drop in rubber costs in 2015.

Luc Minguet, a former board member of RLU, advised Voxeurop that “the unique plan was to have banks finance the undertaking. Nonetheless, regardless of WWF’s involvement within the undertaking, no conventional financial institution agreed to finance it. They did not suppose it was worthwhile sufficient.”(1)

Alex Wijeratna, senior director at Mighty Earth, agrees: “The banks’ due diligence will need to have proven up intensive deforestation, reviews of violent battle with native communities and allegations of land grabbing through the pre-establishment section of the RLU undertaking in Jambi. Most probably these circumstances put them off these from financing it.” Solely simply launched, the undertaking was floundering.

sFortunately for Michelin, in October 2016 a golden alternative to bail out the three way partnership introduced itself when BNP Paribas financial institution co-founded the Tropical Landscapes Finance Facility (TLFF) with the assist and oversight of the United Nations Setting Programme (UNEP). Accepted by the Indonesian authorities and primarily based within the capital Jakarta, TLFF describes itself as an modern financing platform for business ventures associated to the Paris Local weather Settlement (simply signed in 2015, extra on that later) and the Sustainable Improvement Targets.

“Except we persuade the personal sector – utilizing the prospect of revenue – to have a look at manufacturing in a different way, nothing will change,” mentioned a supply from Asia Debt Administration (ADM Capital), a Hong Kong-based funding agency. The supply, who wished to stay nameless, was talking to Voxeurop. As co-founder of TLFF alongside the UN and France’s BNP Paribas financial institution, ADM Capital was answerable for making certain that the funded initiatives met particular efficiency circumstances.

Satya Tripathi is the previous TLFF secretary basic and co-founder when he was the director of the Indonesian workplace of the United Nations UN-REDD (Decreasing Emissions from Deforestation and Forest Degradation) programme. The present secretary basic of the World Alliance for a Sustainable Planet, he advised Voxeurop that Michelin and its Indonesian accomplice Barito Pacific contacted the TLFF in November 2016.

It was simply weeks after this funding platform’s launch by the UN’s environmental arm and BNP Paribas. The French financial institution, whose declared goal was to “unlock personal finance […] that reduces deforestation and forest degradation and restores degraded lands”, had been searching for an emblematic first undertaking to draw green-minded buyers. RLU’s candidacy got here on the proper time. For all involved, it was a golden alternative.

Following a certification course of whose transparency and sincerity elevate many questions (see Chapter 2), TLFF launched its pilot providing (TLFF I) of long-dated bonds within the spring of 2018, to “assist finance a sustainable pure rubber plantation […] in two provinces in Indonesia” (2).

BNP Paribas took over the advertising and marketing of the inexperienced bonds issued by TLFF, which might use the proceeds of the bonds to supply a mortgage to RLU. This mortgage would permit the Indonesian firm to speculate in order to extend the yields of its plantations, and thus enhance monetary profitability of the bonds. And BNP Paribas and ADM Capital obtained a pleasant fee within the course of (3).

Royal Lestari Utama’s companions, buyers and advisors

Now think about an environmentally acutely aware European investor, who drives an electrical automobile with Michelin tyres. They skim over the phrases within the BNP Paribas prospectus (4) that satisfied them to purchase inexperienced bonds: “this as soon as absolutely forested panorama has suffered extreme deforestation in recent times”; “the Debtors have already planted roughly 18,076 hectares of rubber timber by December 2017”; “[they] plan to generate […] pure forest areas offering habitat for tigers, elephants, and orangutans” and “carbon sequestration by means of the event of rubber plantations”. The investor’s cash is actively preventing local weather change, whereas on the identical time holding out the prospect of revenue. Win-win.

Deforesting, then “reforesting” with inexperienced bonds

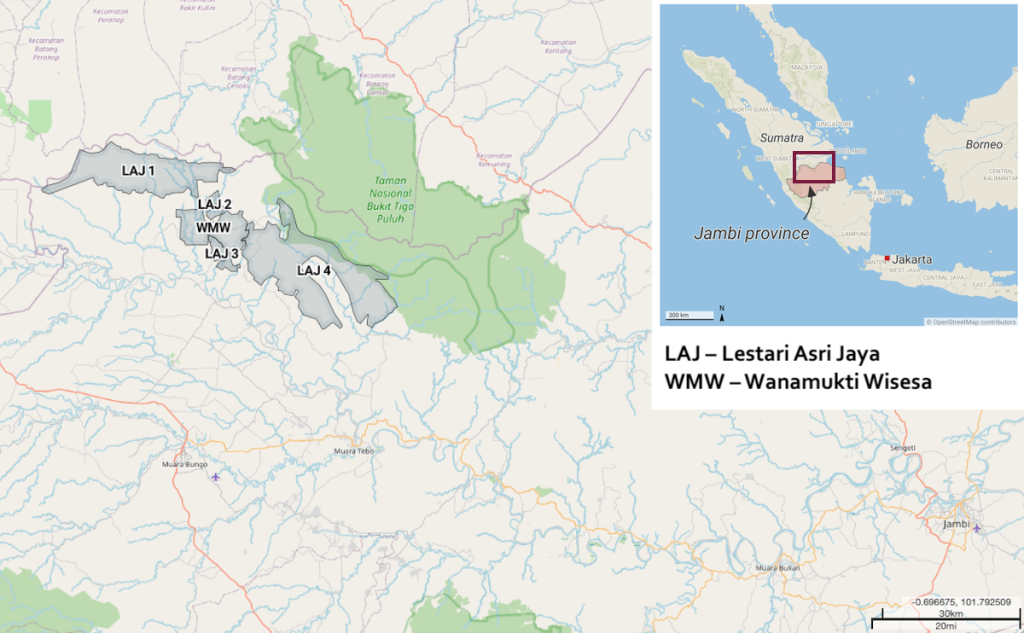

Alas, that isn’t the total story. Our investigation reveals that the story didn’t start in 2014 with a handshake between Michelin and Barito. It began a number of years earlier. The signing of the three way partnership got here just some months after the top of an enormous forest clearance operation initiated in 2010 by one among Royal Lestari Utama’s subsidiaries, Lestari Asri Jaya (LAJ), on the gateway to the Bukit Tigapuluh nationwide park in Jambi province (on Sumatra).

Michelin was already absolutely conscious of this deforestation (see Chapter 2) when it started discussions with Barito Pacific that led to the 2014 settlement. This was properly earlier than it sought to have its rubber plantations financed by inexperienced bonds, below the banner of reforestation.

Michelin workers had in actual fact visited the LAJ concession a number of instances since 2013, when the strategic partnership with Barito Pacific was launched (5). However whereas the French multinational was conducting area surveys and negotiating its take care of the Indonesian conglomerate, in RLU-owned concessions in Jambi bulldozers belonging to a Barito subsidiary have been relentlessly destroying lush vegetation as a way to change it with rubber timber. These operations primarily befell within the LAJ concession, however the smaller neighbouring Wanamukti Wisesa (WMW) concession was additionally affected (6).

Classes