This text is reserved for our members

On Prague’s Pařížská Avenue – probably the most costly in Central Europe – is a discreet darkish brown door. Behind it’s the headquarters of the Energetický a Průmyslový Holding – or EPH, a holding firm. That is Czechia’s largest firm, whose dividends to its shareholders in 2021 amounted to nearly €850 million. It’s owned by businessman Daniel Křetínský, whose private fortune approaches 120 billion Czech crowns (CZK), nearly €5 billion.

Daniel Křetínský is a Czech lawyer whose profession started on the Slovakian monetary group J&T. A jack-of-all-trades, he has investments in vitality throughout Europe, within the French media (together with the newspaper Le Monde), within the funding fund Vesa, within the British Royal Mail and the Dutch postal service PostNL. In September 2022, Křetínský – the fourth richest Czech citizen – purchased a luxurious mansion close to Paris for tens of thousands and thousands of euros, which he plans to transform right into a resort. He additionally owns the Sparta Prague soccer membership and a stake in London’s West Ham United.

Within the first half of this 12 months, EPH posted a revenue of practically €1.3 billion – barely greater than in the entire of 2021. The reason being apparent. Much more than final 12 months, EPH is benefiting from rising costs for electrical energy and gasoline. The present disaster precipitated by the Ukraine struggle is a contributing issue.

A superb disaster

Paradoxically, at the moment’s vitality disaster is saving Křetínský’s firm. EPH Holding’s development in 2021 was due completely to the rise in vitality costs.

Till now EPH has targeted on the transport of Russian gasoline to Europe, however this stays a shaky enterprise. As the corporate lately admitted, adjustments to long-term contracts or to regulated tariffs may have a “vital damaging impact on the group’s enterprise”.

Křetínský has lots to fret about. EPH’s historic development was due completely to its stake within the Slovak firm Eustream, the biggest Russian gasoline transporter to Europe. The funding was made in 2013 for an estimated €2.5 billion. It was a juicy deal: his holding firm grew from CZK 81 billion to CZK 340 billion (about €14 billion) in property, its revenues greater than doubled in a 12 months, and it ended up as one of many three largest Czech corporations. This meant sufficient money to increase quickly within the gasoline sector and, above all, to pay again billionaire Peter Kellner’s monetary group PPF, which had invested in EPH when it was based (Kellner in the meantime died in a helicopter crash in Alaska in 2021).

How Křetínský bagged the golden goose

Shopping for the Slovak gasoline energy crops wouldn’t have been doable with out the blessing of the authorities in Bratislava. On the time, the federal government was led by the social democrat Robert Fico. This was the primary time – however not the final – that the Fico authorities would assist EPH to purchase Slovak vitality corporations.

In 2012, for instance, EPH purchased a 49% stake in Slovenský Plynárenský Průmysl (SPP) from its French and German house owners, GDF Suez and E.ON. SPP manages, amongst different issues, the Eustream gasoline pipeline, which runs via Slovakia and is among the principal gateways for Russian gasoline to the European Union. The deal was made with the consent of the Slovak authorities, in a transaction valued at €2.6 billion. The Slovak state retains a 51% stake in SPP, however EPH exerts the managerial management.

Obtain the most effective of European journalism straight to your inbox each Thursday

The sale was preceded by a take care of the Fico authorities, below which EPH would hand over its loss-making home gasoline provide division to the state in alternate for the federal government sustaining its safety of EPH’s “golden goose”: the transit of Russian gasoline via Slovakia, offered by Eustream. SPP has a long-term gasoline provide contract with Russia‘s large Gazprom that expires in 2028.

As a part of the deal, shareholders would have shared an annual dividend of at the very least €600 million per 12 months for 5 years. To purchase the shares, EPH secured a €1.5-billion mortgage from a global consortium of banks. It then raised the funds wanted to repay the mortgage by the use of pre-agreed dividends and a discount within the share capital of over €1.2 billion.

By way of a construction based mostly within the Netherlands, GDF Suez and E.ON had for his or her half saddled Eustream with debt, via a bond problem value nearly €1.25 billion. EPH subsequently de-facto financed the whole buy with funds it had itself taken from the corporate it was shopping for.

Robbing Peter to pay Paul – it’s a technique that Křetínský appears to know effectively. In 2015, EPH had raised greater than €750 million in loans from Slovak gasoline corporations via its subsidiaries. Once more, it didn’t must pay them again out of its personal cash: they have been merely rolled into future dividends. In three years, greater than €1.75 billion was taken from Slovak gasoline energy crops for EPH’s investments and to repay its different shareholder, PPF. In finance, cash can’t be left to sleep. One should make investments it, whether or not or not one has it.

Investing in any respect prices

Though EPH barely decreased its loans and credit between 2016 and 2020, this case didn’t final. The group’s debt elevated by nearly €1 billion from 2020 to 2021. And in line with outcomes for the primary half of 2022, the quantity of long-term loans and credit continues to develop.

EPH paid file dividends in 2020 whereas reporting greater debt the next 12 months. On the finish of 2020, earnings from gasoline transmission operations accounted for 38.8% of whole group earnings, however solely 23.3% a 12 months later. In accordance with EPH’s annual report, earnings from gasoline transport had fallen by 53% in a single 12 months. And the struggle in Ukraine had not even began but.

With one hand, Křetínský makes his investments outdoors the vitality sector with funds from EPH. With the opposite, he drives his firm into debt. In the meantime, his private fortune retains on rising: from CZK 8 billion in 2013 to CZK 119 billion now – about €4.8 billion. A rise of greater than a 3rd in comparison with final 12 months.

Investments have continued in 2022 – and never simply in French actual property. Because the begin of the struggle in Ukraine, Křetínský has introduced plans to extend his stake within the On line casino Group and the Fnac-Darty retail chains, two French corporations the place he’s concerned alongside the Slovak investor Patrik Tkáč.

A dangerous enterprise

Your entire EPH group is now de-facto based mostly on two pillars: EP Infrastructure, which transports, shops and distributes gasoline; and EP Energy Europe, which focuses on energy era.

The group’s internet debt is €4.5 billion. Of this, absolutely €2.9 billion belongs to EP Infrastructure, which seems to be extremely leveraged and subsequently dangerous.

That is additionally evident from the loans and bonds with which EPH has financed its acquisitions prior to now. Most of those are on the books of EP Infrastructure. And it’s this department of the holding firm that’s now threatened by the decline in Russian gasoline provides: the decrease the amount of gasoline transported, the much less revenue EP Infrastructure makes and the much less ready it’s to repay its money owed to banks and traders.

The group acknowledges this menace within the prospectuses of the bonds it points: “It’s doable that the EPH group might face a liquidity scarcity that would finally have an effect on its means to repay its money owed,” reads the doc printed this summer season.

New money owed for Slovakian energy crops

The state of affairs of the extremely indebted Slovenské Elektrárne, which produces nearly 60% of Slovakia’s electrical energy (nearly half of which is nuclear), may additionally have an effect on the general well being of the group. On 28 July 2016, EPH, via its subsidiary EP Slovakia BV, acquired 50% of Slovak Energy Holding BV, which in flip owns 66% of Slovenské Elektrárne.

Křetínský subsequently acquired a stake in Slovenské Elektrárne’s energy crops from the Italian firm Enel (which owns the remaining 50 p.c of Slovak Energy Holding BV). He has an choice for a further 33 p.c of the shares after the start-up of the 2 items of the Mochovce nuclear energy plant, which remains to be below building. The third unit is already within the check part, however the price of the entire mission has turn out to be prohibitive, bringing Slovenské Elektrárne to the brink of chapter and swelling its debt to over €4 billion.

Enel and EPH agreed in 2020 to supply extra loans of €570 million and €200 million respectively to the corporate. By buying an additional 33% of Slovenske Elektrárne (between 2026 and 2032), EPH would additionally tackle the duty to repay the loans of its former companion Enel, to the tune of €1.3 billion.

It isn’t but clear how EPH will deal with its different money owed – practically €1 billion – as soon as it takes management of the Slovak firm. In the meanwhile, Křetínský’s holding firm has not but included Slovenské Elektrárne, so its debt has not but been included within the firm’s outcomes.

So whereas Křetínský speculates in different sectors with vitality revenues, his corporations are more and more indebted and going through unsure instances. The gasoline infrastructure is below menace, the coal-fired energy crops too – and loads will depend on political selections at European stage.

The previous enterprise mannequin, made viable by gasoline revenues that have been thought-about risk-free and extremely regulated till spring 2022, now seems to be shaky. However Křetínský appears to thrive on uncertainty, as evidenced by the opacity of the Cypriot and Luxembourg corporations the place the earnings of his corporations would seem to land.

An opaque possession construction

The island of Aphrodite is residence to a veritable nest of Russian dolls, thanks specifically to the opacity assured by Cypriot firm rules.

EPH Holding is at the moment 44%-owned by Patrik Tkáč’s holding firm J&T Vitality, with the remaining 56% owned by EP Company Group – itself owned by Křetínský. Based in 2019, this different Czech firm has not but issued an annual steadiness sheet. In accordance with Slovakian data, EP Company Group is 89.29%-owned by EP Funding Sarl, with the remaining 10.71% owned by the Cypriot firm Tilia Cordata (the Latin title for lime tree). Nonetheless, the latter will not be talked about in EPH’s annual steadiness sheet, and Křetínský seems to be its final helpful proprietor, regardless of proudly owning solely 7.44% of the corporate.

The knowledge contained within the Czech firm register – i.e., that EP Company Group was 100%-owned by EP Funding Sarl till November – subsequently doesn’t correspond to what’s contained within the Luxembourg and Slovak registers. In a number of Luxembourg annual experiences, it seems that the remaining 90.56% of Tilia Cordata’s shares are held by “senior EPH executives who’ve invested within the firm”. This has been confirmed by firm spokesman Daniel Častvaj: “The last word beneficiaries of Tilia Cordata, other than Daniel Křetínský, are merely chosen members of EPH administration.”

Sleight of hand

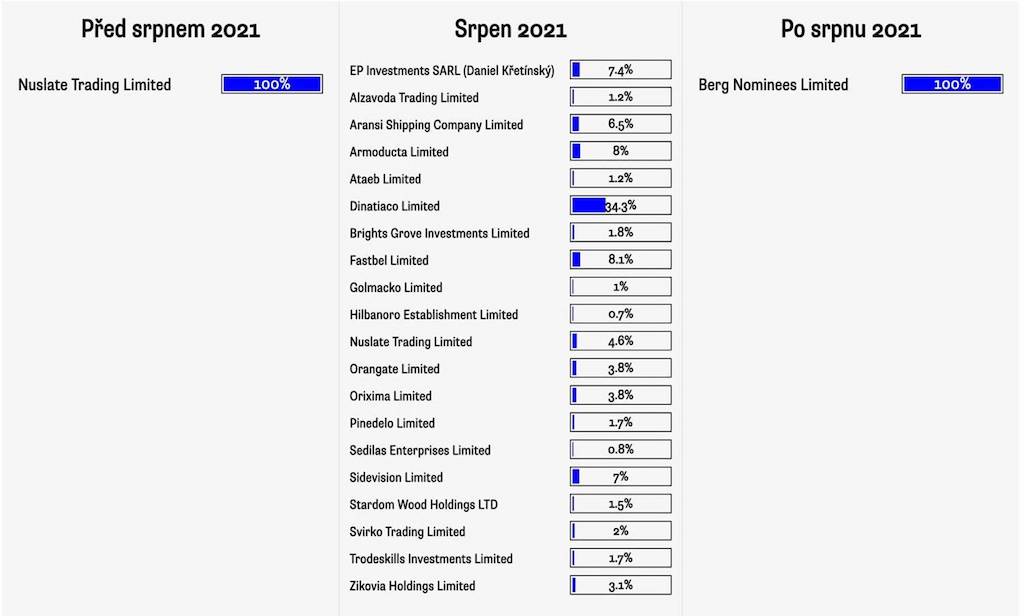

Up to now, Tilia Cordata was managed by one other Cypriot firm, Nuslate Buying and selling Restricted. Then in August 2021 the corporate was restructured in a peculiar means: the one supervisor was changed by twenty totally different corporations, every with a separate shareholding.

The shareholding within the firm owned by Daniel Křetínský – via EP Funding Sarl – is the one one that may be established from public sources. Eighteen of those corporations are Cypriot, and one results in the British Virgin Islands.

It’s via these corporations that EPH’s “prime managers” then personal shares in Tilia Cordata. When requested who’s behind the businesses, Daniel Častvaj solely says: “The businesses talked about are ‘special-purpose automobiles’ via which the person managers maintain their shares. This isn’t uncommon.”

Their boards are largely made up of Cypriot residents. Solely two EPH board members sit on them. There are additionally three Slovak managers, whose names have appeared prior to now in investigations regarding shell corporations. One different factor connects them: they’re all concerned within the Cypriot firm Bridge International Options Ltd, which runs letterbox corporations for J&T Vitality, the holding firm of Patrik Tkáč (him once more).

As of September 2021, Tilia Cordata returned to an easier system of administration – below the management of Berg Nominees Ltd, a Cyprus-based shell firm whose shareholders are by definition nameless. This lack of transparency appears to please Křetínský and his “senior managers”.

No info on Berg Nominees Ltd is current within the Slovak register of public-sector companions. The EPH spokesperson denies that the corporate has violated its authorized obligations, which is confirmed by a specialist lawyer consulted for this investigation. However ultimately, is it acceptable for a holding firm of EPH’s measurement and significance to cover its actual shareholders? Častvaj stays unmoved: “After all [it is]. The banks and regulators concerned have detailed info they usually haven’t any drawback with it. They definitely do not contemplate it ‘opaque’.”

On this ballet of Russian dolls, the place corporations personal one another and hidden shareholders transfer from one board to a different, it may be arduous to search out what you got here searching for. So the Russian gasoline revenues amassed by EPH appear protected, for now.