If historical past is correct, buckle up — it should be a bumpy trip

Opinions and proposals are unbiased and merchandise are independently chosen. Postmedia might earn an affiliate fee from purchases made by means of hyperlinks on this web page.

Article content material

Good morning,

Commercial 2

Article content material

Article content material

Inflation within the eurozone simply went by means of the roof.

Information out this morning confirmed client costs jumped by a file 10.7 per cent, blowing previous economists’ expectations and suggesting that the wild inflationary trip the world has been on the previous 18 months is way from over.

Is there any finish in sight?

One theme over this turbulent time is how coverage makers and economists have underestimated the magnitude and path of inflation, say Deutsche Financial institution researchers.

Within the early days we had been assured that inflation was “transitory,” introduced on world provide chain issues, the Russian-Ukraine warfare and the extraordinary swell of demand of shoppers free of COVID lockdowns.

The tune has modified since then, as inflation proves stickier than anticipated and central banks wrestle to carry runaway costs underneath management.

Commercial 3

Article content material

Deutsche says present world consensus expects us to be again at and even beneath 3 per cent inflation two years from now. The Financial institution of Canada in its newest financial coverage report stated that it expects inflation to fall to about 3 per cent in late 2023, then return to 2 per cent in 2024.

Are they getting it proper this time?

“Historical past by no means repeats precisely, however since inflation forecasting has usually been so poor over the past 18 months, it’s price us asking what usually occurs when inflation breaches these thresholds,” Deutsche stated.

The Financial institution checked out previous intervals when inflation spiked in 50 developed and rising markets and found that when inflation rises above 8 per cent because it did earlier this 12 months, it takes round two years to fall beneath 6 per cent, earlier than settling at about that degree for 5 years after the preliminary spike.

Commercial 4

Article content material

“Ought to we have now been so shocked by the stickiness of inflation? Historical past would recommend no, as when inflation has beforehand gone to ranges as excessive as it’s proper now, it’s normally been gradual to float decrease once more,” wrote the researchers. “Moreover, it normally finally ends up settling at a degree a way above the place it was earlier than the inflation spike started.”

Central bankers, together with Financial institution of Canada’s Tiff Macklem and former U.S. Federal Reserve chair Ben Bernanke, have burdened this present bout of inflation won’t be a repeat of previous spikes resembling that seen within the ’70s due to classes discovered. Central banks now have a transparent mandate to maintain inflation underneath management and have responded extra forcefully to the menace this time round.

Commercial 5

Article content material

However one other examine by Oxford Economics, entitled Seven the explanation why inflation may very well be right here to remain, provides attention-grabbing observations about how individuals are perceiving inflation and the efforts to combat it.

Belief in central banks is a matter. Religion within the banks dropped dramatically after the worldwide monetary disaster and European debt disaster and although it has since gained again some floor it stays at average or low ranges in most of the largest eurozone economies, stated Oxford. Within the U.S. lower than half of the general public thinks the Federal Reserve makes choice which might be in the perfect pursuits of the typical American.

“The fragility of individuals’s religion in central banks is essential. Proof means that these with extra destructive views of their central financial institution are much less receptive to its messages, with their medium-term inflation expectations much less strongly anchored and fewer consistent with the inflation goal,” stated Oxford.

Commercial 6

Article content material

Assist for inflation targets and tighter financial coverage could also be restricted as nicely. Within the Financial institution of England’s personal survey solely 36 per cent agree with the financial institution’s targets. Extra individuals assume they’re too low.

A CNBC survey this month discovered that extra individuals assume it is crucial “to guard jobs, even when prices proceed to rise” than “gradual price will increase, even when unemployment rises,” Oxford stated. Solely 30 per cent of respondents to a U.Ok. survey thought that rate of interest hikes can be finest for the British economic system. Half thought charges needs to be reduce or keep the identical.

“That is problematic. Our earlier analysis highlighted a broad decline within the effectiveness of coverage charges amongst superior economies over current a long time. Ought to that stay the case, painfully tight financial coverage could be required for central banks to carry inflation all the way in which again to focus on. Public help for such a coverage seems restricted,” stated Oxford.

Commercial 7

Article content material

Deutsche says whether or not historical past or consensus proves proper about inflation may have a “profound influence” on monetary markets and economies over the subsequent few years.

“If the median by means of historical past is right, then the turbulence of 2022 may show to be just the start.”

_____________________________________________________________

Was this text forwarded to you? Join right here to get it delivered to your inbox.

_____________________________________________________________

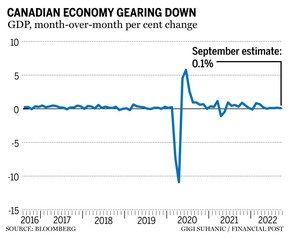

GDP information for Canada out Friday clearly confirmed an economic system shedding momentum, however not less than, as one economist put it, it’s nonetheless rising.

August gross home product rose by 0.1 per cent, whereas forecasters had anticipated a flat studying, and Statistics Canada’s early estimate expects an analogous achieve in September. That places Canada’s progress charge within the third quarter, an estimated 1.6 per cent, at half the tempo seen within the first six months of the 12 months, Bloomberg stories.

Commercial 8

Article content material

Is that sufficient for the Financial institution of Canada?

Some economists say the Financial institution raised its charge 50 foundation factors final week as an alternative of 75 as a result of it believes the economic system is slowing and can proceed to take action. In its financial coverage report Wednesday, the central financial institution acknowledged a 50/50 likelihood of a technical recession in coming quarters.

However few, if any, assume the Financial institution is completed with charge hikes simply but.

“The Financial institution of Canada determined to gradual its tempo of charge hikes on Wednesday because it believes a slowing in financial progress is forthcoming. Although that is beginning to present up within the information, we expect the BoC might want to proceed to boost its coverage charge to 4.25% so as to obtain the deceleration that’s adequate to carry down inflation,” James Orlando, senior economist at TD Economics, wrote in a notice.

Commercial 9

Article content material

___________________________________________________

- Canadian Jesuits Worldwide will host a press convention with Jacques Nzumbu, a Jesuit priest from the Democratic Republic of the Congo and a specialist in battle minerals. He’ll communicate out on the influence of mining actions in his nation and talk about what will be achieved to make sure that mining corporations, a few of them Canadian, adhere to human rights and environmental due diligence

- The standing committee on transport, infrastructure and communities meets about anticipated labour shortages within the Canadian transportation sector

- Former CannTrust Holdings Inc. leaders court docket listening to

- In anticipation of potential enlargement to Victoria, UBER hosts an info assembly for would-be drivers

- As we speak’s Information: Bloomberg Nanos Confidence, Chicago PMI

- Earnings: Fairfax Monetary Holdings, IAMGOLD, Brookfield Asset Administration, Knight Therapeutics, Turquoise Hill Sources, Park Garden, Obsidian Vitality, Stelco Holdings

Commercial 10

Article content material

___________________________________________________

_______________________________________________________

Even in case you have spent a long time making ready, surprises are more likely to come your means the primary 12 months of retirement. Earlier than the surprising hits, our content material companion MoneyWise has 5 methods retirees, and people about to make the leap, have to put in place.

____________________________________________________

As we speak’s Posthaste was written by Pamela Heaven, @pamheaven, with further reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? E-mail us at posthaste@postmedia.com, or hit reply to ship us a notice.

Take heed to All the way down to Enterprise for in-depth discussions and insights into the most recent in Canadian enterprise, accessible wherever you get your podcasts. Try the most recent episode beneath:

Commercial